A few words about cryptocurrency

In some form or another, payments for goods and services go right back to the earliest trade relationships between humans. For millennia, those payments were made in kind. Later, money began to be minted - and this remained the dominant way to pay for two thousand years. But we're now in the grip of a payment revolution: currency is going digital.

The release in 2008 of Satoshi Nakamoto's paper Bitcoin: A Peer-to-Peer Electronic Cash System signaled a massive leap forward in ecommerce financial infrastructure. And while blockchain technology may sometimes seem a little ahead of its time, it's safe to say that Bitcoin and other virtual currencies have immediate potential forecommerce marketplaces.

One example: just under a year back, CoinPayments, one of the world's biggest cryptocurrency payment gateways, was integrated into the Shopify platform. This brought crypto closer to mainstream consumers, letting them shop online using over 300 cryptocurrencies for payment.

At Roobykon, we're firm believers that integrating cryptocurrency payments into your marketplace represents a sound and necessary innovation - one that can boost trust, increase efficiency, and enhance the customer experience. In this article, we'll lay out just why we have such belief in the blockchain marketplace.

What Is Cryptocurrency, and Why Has It Revolutionized Electronic Payments?

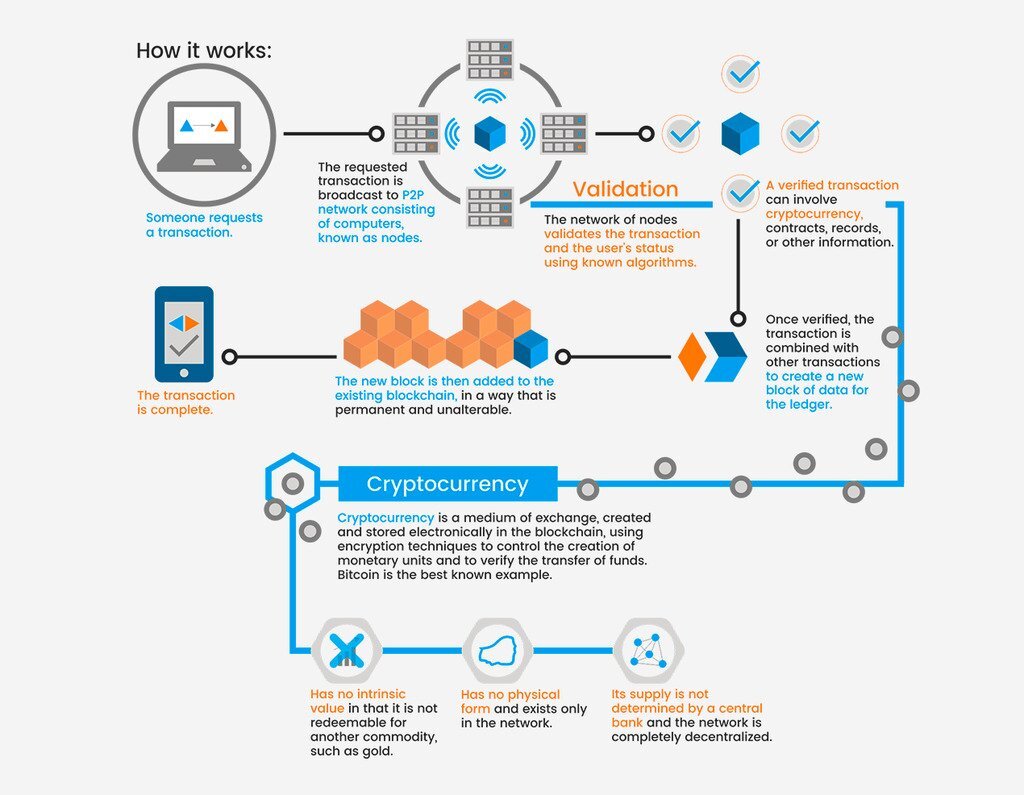

Simply put, cryptocurrency is a virtual monetary unit. Unlike the traditional 'fiat' money that's stored in your online bank account as euros, dollars, or yuan, cryptocurrency has no physical form - it's acquired and used virtually. Its existence is underwritten by advanced cryptography, while acquisition is performed by solving complex mathematical problems.

One of the main reasons for virtual currencies' growing popularity is that they do away with contract mediators, such as banks. Every cryptocurrency payment has an inbuilt protection against fraud: instead of the data that makes it up being stored on a centralized system, it is distributed across a 'chain' of 'blocks' that are accessible to both parties but which cannot be modified without meeting strict requirements. All this makes break-ins extremely difficult.

Long Before the Revolution ...

The concept that lies behind cryptocurrency was introduced in the early 1980s when the American cryptographer David Chaum invented an algorithm named 'blinding'. Chaum's invention remains a core part of modern network encryption, enabling safe information exchange between contract parties. The algorithm also laid the foundation for future forms of electronic transactions.

Chaum founded the company DigiCash to begin producing digital monetary units - but unlike modern cryptocurrencies, these existed on a centralized system, with the company retaining sole control over them.

Then, in 1998, a programmer named Wei Dai published a paper that explained many of the basic components of modern cryptocurrency payments - including decentralization and user anonymity.

Not long later, Nick Szabo used blockchain technology to create a cryptocurrency called 'bit gold'. But sadly for Szabo, it never quite caught on, either in the B2B or B2C sectors.

When Bitcoin appeared it became the first cryptocurrency to successfully bring together decentralized administration and comprehensive anonymity protection with a blockchain recording system and built-in deficit (more on that later). This was to prove a winning combination.

What's fascinating in all this, though, is that Satoshi Nakamoto never, in fact, set out to create a currency, as such - rather, the goal described in his paper was the realization of a 'peer-to-peer electronic cash system'. Nonetheless, by January 21st, 2009, the first bitcoin financial transaction had been made - and the way had been paved for the wave of alternative 'altcoin' currencies that would begin appearing on blockchain marketplaces the following year.

Towards the end of 2012, WordPress became the first major vendor to accept payment via bitcoin - setting us on the path toward mainstream cryptocurrency marketplace integration.

A few fun facts about Bitcoin:

- The supply of bitcoins is limited, as predefined by the so-called 'built-in deficit' - with the total number that can be created set at 21 million. However, the 'mining' process is set to become increasingly complex, and the last coin is not expected to 'come out of the ground' until around 2140.

- In actual fact, the matter of who created Bitcoin remains a mystery: 'Satoshi Nakamoto' is a pseudonym that could belong to either a single person or a group of programmers

- There are more than 30000 bitcoin ATMs around the world, most located in the US, Canada, andEurope

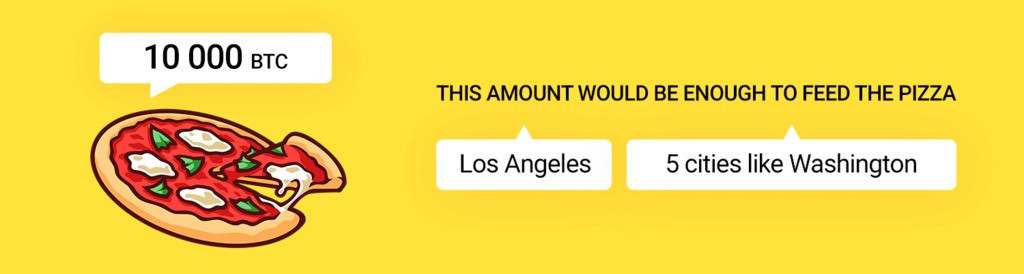

- The first purchase using Bitcoin was made in 2010 by a miner named Laszlo, who bought two pizzas for 10,000 BTC. At today's exchange rate of around $3,800 USD to 1 BTC, those coins could buy a pizza for every resident of Los Angeles or 5 cities like Washington.

- In one of the worst stories of bitcoin misfortune, a British man accidentally dumped a hard drive containing 7,500 BTC

- With the huge value of a single coin, it's essential to pay close attention: in 2013 a bitcoin user accidentally paid 80.99 bitcoins when they'd meant to pay just 0.01. The cost of the mistake was equal to around $50,000.

From the First Coin to the Cryptocurrency Boom

Bitcoin remains the 'poster boy' for cryptocurrencies across the board - not surprising, considering it was the first to achieve traction and is still the highest-performing. But the number of other cryptocurrencies on offer has ballooned - to more than 1750 at the last count.

Why Your Marketplace Needs Cryptocurrency Payments

The openness of e-commerce to new and innovative technologies is what makes it one of the fastest-growing sectors in both B2B and in B2C commerce. Given the huge and justified buzz around cryptocurrencies, not to mention the very tangible advantages they offer to buyer and seller alike, marketplace owners really should pay very close attention.

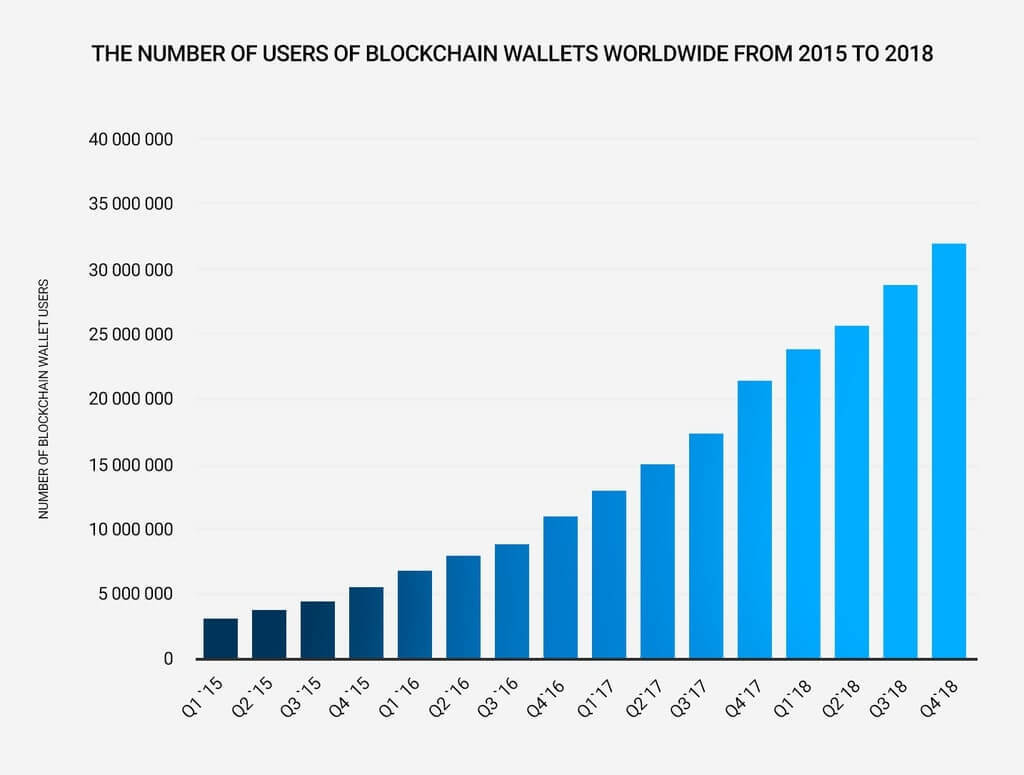

Bitcoin has had its well-publicized ups and downs, but the overall number of wallet users is growing steadily - indicating strong underlying public interest in this emerging technology.

Cryptocurrency Is a Great Solution for Your Customers

The reasons that people are looking ever wider for ways to pay online are diverse and complex - but integration of cryptocurrency payment into your traditional marketplace can offer a broad-based solution to a range of concerns and needs that customers may have.

More privacy means more trust

49% of customers have little confidence in online shopping - a huge sticking point for the sector. Meanwhile, some 40% worry about how websites use their personal data, while 57% want to see new laws regulating the collection and use of personal information.

These numbers highlight that privacy and personal data protection are among the key consumer concerns around e-commerce - and are significantly hindering its development.

Modern payment processing companies use centralized databases to store debit and credit card payment data - but a series of large-scale attacks and data breaches have put customers' privacy at risk and shaken consumer confidence.

But as we've already been at pains to highlight, the fundamental structure of payment systems based on blockchain technology makes them extremely resistant to attack. Privacy is hard-wired into cryptocurrencies like bitcoin, while some newer contenders - like Monero, Zcash, and Verge - keep user transactions totally anonymous, hiding information about recipients, senders, and transaction values.

All this makes blockchain-based payment technologies a powerful weapon in marketplace owners' arsenals - both in addressing the real security issues that exist in their sector and in winning the trust of potential customers.

No middleman, lower costs

Online credit and debit card payments typically include a fee ranging from 1% to 3% - and when it comes to international payments, this can rise as currency conversion premiums and cross-border payment processing charges kick in.

Meanwhile, the average Bitcoin transaction fee is close to 1% - thanks to its operation through a decentralized marketplace powered by blockchain. This means lower prices for customers, and bigger profits for your marketplace - win-win!

Cryptocurrency Empowers Your Marketplace

Attract new customers

Today there are thousands of cryptocurrency alternatives to traditional payment systems, and the number of customers willing to use new payment methods is demonstrably increasing. Adding cryptocurrency transactions as an alternative payment method helps you capitalize on security- and budget-conscious new customers who might otherwise go elsewhere.

Lower fraud risk

Chargebacks are a perennial problem in e-commerce - and if they're bad news for big marketplaces, the reputational and financial loss they bring can spell death for new players.

Cryptocurrency payments, on the other hand, are irreversible - customers can't abort a transaction after making payment. Blockchain marketplaces empower customers to resolve legitimate issues but prevent fraudulent and bad-faith claims.

Expand your target audience to the unbanked population

Some 2 billion people live without access to formal financial services, and this 'unbanked' population could benefit enormously from access to online marketplaces -both as buyers and sellers.

Blockchain technology offers tools for marketplace owners to reach out to these potential new buyers and sellers (or even a way for them to become marketplace owners themselves), because setting up a mobile cryptocurrency wallet lacks many of the obstacles of joining a traditional bank.

Integrating Cryptocurrency Payment into Your Marketplace

There are now a huge number of ways to cryptocurrency marketplace integration. Some rely on third-party providers -others don't.

Configure wallets independently

If you want to avoid third-party providers, you'll need to configure your own wallets. This requires some skill, but once it's done, you'll be able to process cryptocurrency transactions directly.

Among the key steps is choosing a hardware wallet. Good, secure options that support a wide range of currencies include Trezor and Ledger Nano S.

Then, to perform currency conversions, you'll need to register with an exchange platform that deals with a range of cryptocurrencies - Kraken is a good example. If you want to work only with top coins, GDAX and Gemini could also work well.

Integrate a provider into your marketplace

Independent wallet configuration is the most cost-effective long-term solution but does require technical expertise. Meanwhile, using a provider does have higher overheads but can offer a simpler way to begin accepting cryptocurrencies.

There is a wide range of offers out there from providers who can help integrate blockchain into your marketplace - and once you're signed up, they'll support you with things like configuration and currency conversion. Using this approach you can begin with a standard configuration but then adapt it to suit your business.

CoinPayments, Coinbase and BitPay are among the most popular payment solutions right now.

Leaderboard: Who Takes Cryptocurrency as Payment?

If you're still not sure how popular cryptocurrency payments actually are, here are just a tiny handful of the blockchain marketplace players who have embraced the benefits of accepting cryptocurrency:

- eBay is the biggest marketplace in the world and was the first to accept bitcoins

- Amazon also lets you pay with coins - it uses the Purse.io tool

- Expedia.com pioneered cryptocurrency payments in the travel booking industry

- CheapAir allows users to pay for flight and hotel bookings with digital money

Cryptocurrencies Do Have Some Risks

We're now a decade into the life of cryptocurrencies, but they do still present some risks, and these need to be properly understood.

Price volatility

The price of Bitcoin and other cryptocurrencies can fluctuate day by day - and as the platform owner, you'll naturally want the $100 you were paid for some good or service to retain at least that value. With cryptocurrencies, the value of your coins can fall (though of course, it can also rise).

As coins grow in popularity and their functions become more diversified, their value should stabilize -but for now, cashing out frequently is the best solution.

Data loss

In spite of the innate security of blockchain systems, funds can still be lost as a result of device loss theft, or server malfunction - there is simply no system out there that will entirely protect you from such possibilities. As ever, it's essential to stay abreast of the latest expert advice.

Why Start Accepting Cryptocurrency Payments Now?

It's never easy to be an early adopter of an innovative but complex new technology - but the rewards on offer make the effort worthwhile. As Jia Wertz put it in a piece for Forbes, "We're still early in the days of crypto e-commerce. For early adopters it's a great time to start trading in crypto before their competitors do."

As we've mentioned before, a pro-coin stance can both turbocharge your marketing operation and help you stick it to your competitors - who, as the e-commerce market grows, are becoming more numerous by the day.

Take a look at some more numbers…

- The global e-commerce market is expected to reach $4.8 trillion in 2025. Some sources project even higher figures, with one report estimating $6.8 trillion in e-commerce sales

- There are 2.77 billion online shoppers globally in 2025, representing 33% of the world's population

- 21% of retail purchases are expected to take place online in 2025. This share is anticipated to rise to 22.6% by 2027

- Revenue in the e-commerce market is projected to reach US$4,324.00 billion in 2025.

- The global B2C e-commerce market size is calculated at USD 7.81 trillion in 2025

- The global e-commerce market size reached USD 26.8 Trillion in 2024. Looking forward, the publisher expects the market to reach USD 214.5 Trillion by 2033, exhibiting a growth rate (CAGR) of 25.83% during 2025-2033

Cryptocurrency Payments: the Future of Your Marketplace

It's still unknown exactly how cryptocurrency growth will impact e-commerce - but it's clear that the future of the two is inextricably linked. Some experts claim that the emergence of blockchain systems will have an effect more seismic than the invention of the Internet itself - and whether or not that's true, it's clear those systems have an outsized role to play in the future of payments.

It's extremely like that the companies that will come off best in the move to digital money are those that begin to embrace it now. The number of Blockchain wallet users grows by 50,000 every day. If you don't reach out to this new market, you can be sure your competitors will.

At Roobykon, innovative technologies are in our blood. We're specialists in custom marketplace platform development, providing complete solutions for e-commerce - and understanding how to get the absolute best from payment systems is a huge part of that.

Our team of professionals can implement high-quality cryptocurrency payment systems within an attractive timeframe. So if you're ready to move your business forward in this important new direction, we'd love to hear from you.