Roobykon is constantly inspired by the way digital platforms are reshaping how we move, travel, and connect with our cities. Among the most disruptive and innovative sectors we've seen in the marketplace world is vehicle sharing (specifically car, boat, and bike sharing platforms). These examples are about redefining ownership, sustainability, and access in the mobility economy, pushing the limits of the car-share business model.

According to recent data, the global car-sharing market was valued at USD 8.93 billion in 2024 and is projected to reach USD 24.4 billion by 2033, growing at an impressive CAGR of 11.8% from 2025 to 2033. Notably, Europe leads the charge, accounting for over 50.2% of the global market share in 2024, thanks to its urban density, strong environmental policies, and progressive transportation culture.

This kind of exponential growth signals a fundamental shift in how mobility is being reimagined, one where platforms become the engines of change, powering more flexible, efficient, and user-centric alternatives to traditional vehicle ownership. The success of the adjacent ride-sharing business model reflects the growing demand for access-over-ownership solutions that are smarter, greener, and more adaptable to evolving urban lifestyles.

So, what does this booming industry look like under the hood?

What is the car-sharing business model?

Let’s start with the basics. The car-sharing business model is a service model that allows individuals to access vehicles for short-term use (usually by the hour or day) without having to own them. Think of it as renting, reimagined for the digital era. But this isn’t just about convenience! It’s a radical shift in how we think about mobility and ownership.

Instead of buying a car that sits parked 95% of the time, users can book a car when they actually need it, via an app, instantly, without paperwork or queues. And it doesn’t stop at cars. The same model is transforming bike rentals, e-scooter fleets, and even boats in coastal and lakeside regions.

What’s more, there are several types of car-sharing models emerging. Each one comes with its own operational logic, user base, and technical requirements, making the market incredibly diverse and innovation-friendly.

Behind the scenes, these platforms are beautifully complex digital ecosystems. They bring together:

- Vehicle owners (individuals or businesses),

- Renters (travelers, locals, commuters),

- Logistics infrastructure (tracking, location services, smart locks),

- Platform operators who orchestrate the entire experience.

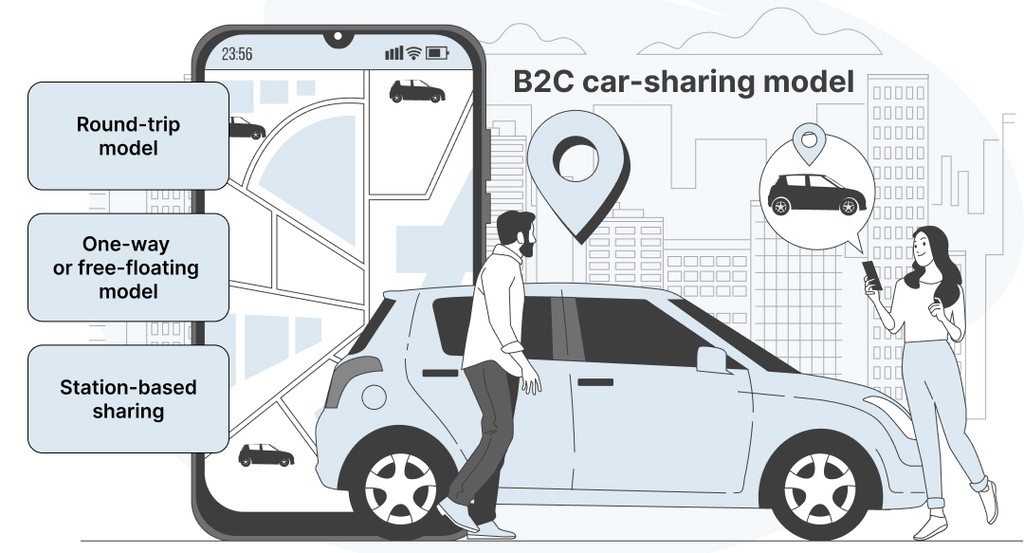

B2C (business-to-consumer) car-sharing model

As this sector evolves, we’re seeing several dominant bike-sharing business models emerge, each with its own logic, tech stack, and monetization strategy.

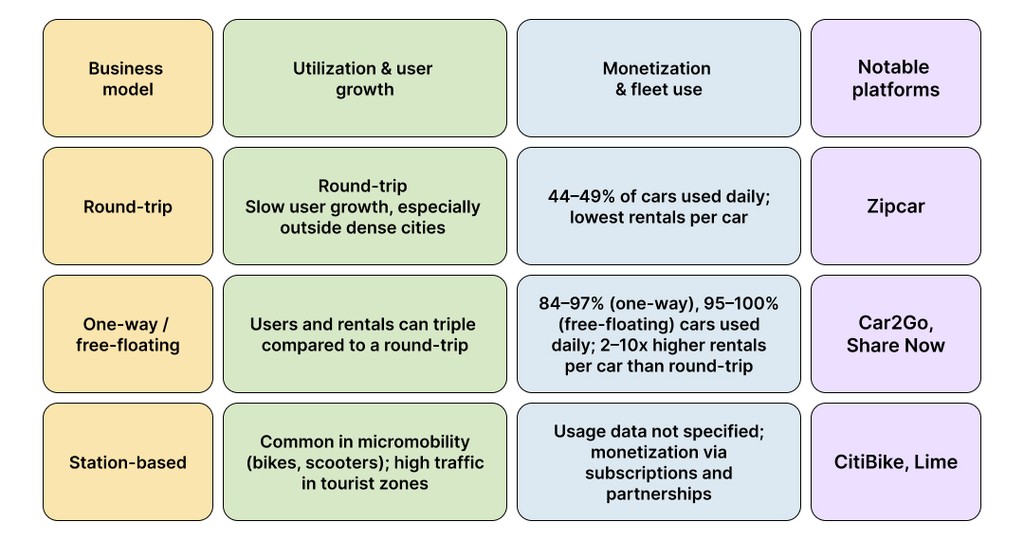

Round-trip model

The round-trip car-sharing format requires users to pick up and return the vehicle to the same location. It's ideal for planned trips and works well with stations or hubs, often used by platforms like Zipcar.

- Monetization: Usually hourly or daily rental fees.

- Tech needs: Location-based scheduling, smart locks, and booking management.

One-way or free-floating model

The one-way trip car-sharing model lets users pick up a vehicle in one location and drop it off elsewhere within a service zone. The one-way car share offers more flexibility and supports spontaneous, urban travel.

- Monetization: Per-minute or per-kilometer charges, dynamic pricing models.

- Tech needs: Real-time GPS, geofencing, advanced fleet tracking, and automated billing.

Station-based sharing

Often used in bike and scooter sharing, this system relies on fixed stations where users check in and out equipment. It supports high-traffic zones and tourist-heavy areas.

- Monetization: Subscriptions, usage fees, corporate partnerships.

- Tech needs: IoT device integration, mobile-first UX, subscription logic.

P2P (peer-to-peer) car-sharing model

What is peer-to-peer car sharing? P2P car sharing is a bold reimagining of ownership. Often dubbed the “Airbnb for cars,” the peer-to-peer car-sharing business model lets everyday car owners rent out their vehicles directly to others, monetizing idle time (which is most of the time, considering cars sit unused over 90% of the day) and maximizing asset utilization in a way that benefits both owners and renters.

What's fascinating is how peer-to-peer car sharing companies have unlocked access in places where traditional models simply can't operate profitably, like rural towns, suburbs, or low-density neighborhoods. By tapping into local vehicles and eliminating the need for expensive fleets and infrastructure, P2P ride-sharing platforms are creating hyper-local economies of mobility.

Real-world example: Turo

Turo is the undisputed heavyweight in the P2P space. Operating in over 7,500 cities and 300 airports, it offers more than 1,300 makes and models, from budget hatchbacks to luxury Teslas. Car owners can deliver vehicles to custom locations, leave them at airports, or simply arrange local pick-ups. Renters get flexibility, affordability (often 30% less than traditional rentals), and a wide range of vehicle options rarely found on rental lots.

Real-world example: Getaround

Getaround brought a game-changing innovation to the table with its "Getaround Connect" system, a keyless entry device that lets users instantly book, unlock, and drive cars using just their smartphone through their P2P car-sharing app. No need to meet the owner. No awkward key handoffs. This seamless tech has made Getaround especially popular in dense urban areas, where time and convenience rule.

Bonus story: Hiyacar’s trust tech

UK-based Hiyacar introduced facial recognition and advanced identity checks to help build trust, a common challenge in P2P mobility. Their bold vision? To be present on every street in the UK and change the way people use cars forever.

Other noteworthy platforms

Snappcar (Netherlands) and GoMore (Denmark): These European vehicle sharing platforms have exploded in popularity by offering keyless sharing tech and community-driven pricing models.

B2B (business-to-business) car-sharing model

The B2B car-sharing model flips the traditional fleet ownership paradigm on its head. Rather than every department or office maintaining its own set of vehicles, businesses now share a centralized pool, optimizing costs, reducing idle time, and streamlining logistics through smart platforms.

This boat-sharing model is popular in industries like logistics, utilities, public services, and even education, where staff often need access to vehicles but don’t require individual ownership. Think of it as "in-house car sharing" with tech at the wheel.

Interesting fact

Even governments are jumping on board. Cities like Berkeley (USA) and Paris (France) have used car sharing to downsize municipal fleets, reducing both expenses and emissions.

Real-world example: Ridecell

While many B2C car-sharing brands like Zipcar also offer corporate packages, examples of ride-sharing companies like Ridecell specialize in enterprise-grade car-sharing platforms. Their software enables internal fleet sharing, reservation systems, mileage tracking, and even predictive maintenance, all accessed via a mobile app. It’s car sharing tailored for the enterprise world.

Nonprofit car-sharing models: driving equity, one ride at a time

In contrast to commercial platforms chasing growth metrics and teaching entrepreneurs how to make money ride sharing, nonprofit car-sharing models are mission-first, designed to bridge transportation gaps for low-income residents, underserved neighborhoods, and carless households. These organizations deliver empowerment.

The heart of community mobility

Nonprofit car-sharing services are transforming how communities access transportation, particularly in areas where traditional car-sharing doesn’t pencil out financially for private players. While commercial operators focus on how to make money with ride sharing, these models are often grant-funded, community-led, and deeply embedded in local transportation equity goals.

HourCar’s Evie Carshare, for example, launched in Minneapolis and St. Paul with a fully electric fleet of 123 vehicles, specifically serving low-income and BIPOC neighborhoods. The results speak volumes: by the end of 2022, Evie logged nearly 57,000 trips and over 600,000 miles. Its roadmap includes expansion to 175 vehicles, driven by user demand and impact metrics rather than market profit potential.

Accessibility that scales

Míocar, a Central California-based nonprofit, offers ultra-affordable access at just $4 an hour or $35 a day, a game-changer compared to commercial options like Zipcar, which can charge upwards of $19.99/hour or $119.99/day. This price point removes financial barriers and makes it possible for rural residents and lower-income families to access reliable transport for work, errands, and healthcare appointments, prioritizing community impact over making money with car-sharing objectives.

In Buffalo, NY, the original Buffalo CarShare offered rides to members for around $100 per month, a lifeline for a user base where half earned less than $25,000/year. Its impact was so transformative that New York State awarded it $280,000 to expand operations into other underserved cities.

A funding-first ecosystem

Most nonprofit car-sharing models are sustained by federal transportation grants, municipal support, environmental justice funding, and philanthropic contributions. In Denver, eGo CarShare leveraged these streams to install “Multi-modal Toolkits - informational hubs in affordable housing developments, helping residents integrate car sharing into their daily lives alongside biking, walking, and transit.

Many of these programs also partner with community-based organizations, ensuring services are culturally relevant, multilingual, and accessible to populations that often face digital or financial exclusion.

Cooperative ownership: share the wheel, share the power

An innovative twist on nonprofit car sharing comes in the form of cooperative models. In these systems, members aren’t just riders, they’re owners. They can buy equity shares, vote on service decisions, and access discounted rates. This structure fosters community stewardship, local accountability, and a deeply sustainable mobility culture.

Platforms like Modo in Vancouver and Mobility in Switzerland have scaled this model impressively, managing hundreds to thousands of vehicles while staying true to their nonprofit roots.

Interesting facts & stories about nonprofit car sharing

- The very first nonprofit car shares in North America were started by environmental activists and urban planners aiming to reduce single-occupancy vehicle usage, not to make money.

- Míocar was born out of California’s Transformative Climate Communities initiative, designed to reinvest cap-and-trade dollars into the state’s most polluted and underserved communities.

- Evie’s service map was reverse-engineered from community input, and residents voted on where vehicles should be placed, ensuring real utility over theoretical market coverage.

- In many cooperative models, members volunteer as fleet stewards, helping clean, maintain, and even promote the service, turning passive users into engaged stakeholders.

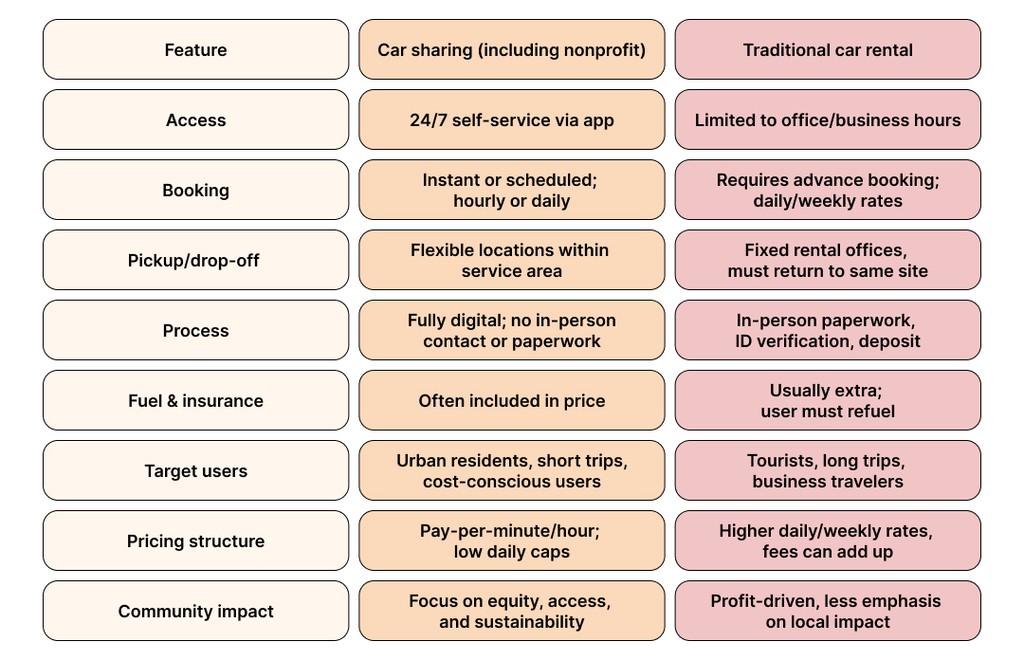

How does car sharing differ from traditional car rental?

While both corporate car-sharing apps and traditional car rentals offer access to vehicles, their business models, user experiences, and community impacts are fundamentally different. Understanding these differences is key for anyone evaluating which option best suits their needs or planning mobility solutions with a social impact lens.

Designed for today’s urban life

Car-sharing system, especially in nonprofit and cooperative formats, is tailored for spontaneity, accessibility, and affordability. Need a car for a quick grocery run, a doctor’s appointment, or a last-minute job interview? A few taps on your phone, and you’re on your way, no need to stand in line at a counter or commit to a 24-hour minimum.

Many vehicle-sharing companies offer contactless entry, real-time availability, and parking zones across the city, making it easy to use a car only for the time you need and then move on. The inclusion of fuel, insurance, and maintenance in the base cost simplifies budgeting, particularly important for users with limited financial flexibility.

Traditional rentals: built for long-haul convenience

Traditional car-sharing service business models, while reliable for extended travel or vacations, are generally less accessible for spur-of-the-moment urban needs. They often require advance planning, physical paperwork, security deposits, and longer rental windows, which makes them less ideal for users who need vehicles for just a few hours or a single errand.

Moreover, traditional bike-share business models prioritize profitability and standardization, which can sometimes come at the expense of local nuance or user-centric design, especially in marginalized or transit-poor neighborhoods.

Noteworthy insights: car sharing as a catalyst for change

- Mobility as equity: Nonprofit car sharing is a lifeline. By offering affordable, app-based, short-term car access, these programs empower users who are traditionally excluded from both car ownership and public transit reliability.

- Electric fleets, cleaner cities: Many nonprofit programs, like Evie and Míocar, are pioneers in electrifying shared mobility, helping lower urban emissions and reducing health risks in overburdened communities.

- Access over ownership: By focusing on shared access rather than private ownership, these programs help reduce congestion, parking demand, and vehicle overproduction - core pillars of sustainable urban planning.

“Members, really, are the driving force... car-share programs must be responsive, convenient, affordable, accessible, and sustainable.”

— Greg Dronkert, President of Zero-Emission Cooperative

Conclusion

The shared mobility model has proven far more than a fleeting trend; it’s a structural transformation of how we think about ownership, transportation, and access. Whether it’s car, boat, or bike sharing, the core principle remains the same: using technology to unlock the full value of underutilized assets and make transportation more flexible, efficient, and inclusive.

The diversity of models reflects the wide range of problems that sharing platforms are solving. From free-floating car-sharing systems that let users pick up and drop off vehicles anywhere within a service zone, to one-way car-sharing floating model approaches that eliminate the need to return cars to fixed stations, innovation is happening at every level. Even boats, once considered luxury-only territory, are now being shared across harbors with the tap of an app. And bikes? They're quietly rewriting the rules of urban movement, one pedal at a time.

But as exciting as the growth is, shared mobility isn’t without its challenges, insurance complexities, fleet logistics, regulatory roadblocks, and the simple fact that not all markets are created equal. Still, the ecosystem is maturing. The winners in this space are those who understand the local context, design for community needs, and create sustainable, scalable experiences.

Ultimately, the future of transportation won’t belong to any one model or platform. It will be multimodal, data-driven, and user-first, blending car sharing, bike sharing, boat sharing, public transit, and even walking into a seamless network of choices. For users, that means more freedom. For businesses and urban planners, it’s a new canvas for innovation. And for entrepreneurs wondering how to start a vehicle sharing business, this diverse ecosystem offers multiple pathways to create a meaningful impact while building sustainable ventures.

Ось оновлена версія вашого FAQ-блоку з доданим **п’ятим питанням** і відповіддю в кінець. Я також зберіг усю існуючу структуру:

FAQ

1. How do ride-sharing companies make money

Ride-sharing companies typically earn revenue by taking a cut from every transaction made through their platform. Whether it's a driver giving a ride through Uber or a host renting out a car on Turo, the platform charges a service fee or commission. Many also offer premium services or subscriptions for frequent users, and some monetize data insights, advertising, or partnerships with municipalities. Those that operate their own fleets (like Zipcar) generate income directly through hourly or per-minute rental rates, often bundled with insurance and fuel.

2. What is an example of a sharing business model?

One of the most practical and successful sharing economy models is car sharing. It enables multiple users to access the same vehicle at different times, dramatically improving asset utilization while cutting ownership costs. From community-driven platforms like Míocar to international operations like Zipcar, the model has been adapted for everything from nonprofit equity programs to app-based urban mobility. You can explore a full spectrum of car-sharing platforms and use cases in this in-depth guide.

3. What is the difference between ride-hailing and ride-sharing?

Though often used interchangeably, these two concepts serve different needs. Ride-hailing refers to booking a vehicle along with a driver, like using Uber or Lyft to get from one location to another on demand. In contrast, ride sharing involves sharing a ride or a vehicle itself, like when you use a Zipcar for a few hours or carpool with neighbors. Ride sharing leans on maximizing vehicle use and reducing the number of cars on the road, while ride-hailing is more about convenient personal transport.

4. How do I build a rideshare app like Zipcar?

To develop a successful rideshare app inspired by Zipcar, you'd need to combine a seamless user experience with powerful backend logistics. The platform must allow users to register, find nearby vehicles, unlock them via smartphone, and handle payments automatically. It should also integrate real-time tracking, fleet management tools, and often IoT hardware for vehicle connectivity. From legal compliance to geofencing, the tech stack must support both scale and reliability. This kind of platform demands deep domain knowledge and strong engineering, something we at Roobykon are well-versed in.

5. Why did Gig Car Share fail?

Gig Car Share entered the market with a promising vision - affordable, app-based electric vehicle access without the hassle of ownership. However, it struggled with the realities many mobility startups face: high operational costs, vehicle damage and vandalism, insurance complexities, and limited user density outside core launch zones. Despite being backed by AAA and offering a user-friendly experience, the company couldn’t scale profitably, especially as cities became saturated with competitors and mobility behavior shifted post-pandemic.